EIIS stands for Employee and Investment Incentive Scheme. The purpose of the scheme is to encourage private individuals in Ireland to invest in Irish private companies in order to help these companies grow and create new jobs.

The way in which the EIIS incentivises Irish investors to invest in these companies is by offering the investor a tax refund of 40% of the amount of their investment, on the basis that the investor leaves the investment in the company for a minimum of 4 years.

Therefore, if you, as an Investor, invest €10,000 in company ABC, you can reclaim €4,000 of this €10,000 from the Irish Revenue Commissioners when you make your tax returns for the year in which you make the investment.

The effect of this is that the most you can lose on this €10,000 investment is €6,000, and even if your investment provides you with a big payback, you still keep the €4,000 tax rebate. This makes a major difference to the risk-reward trade-off of the investment.

It should be noted that the Irish Revenue Commissioners do not deem all companies eligible for EIIS status, so the tax rebate does not apply to companies in every sector.

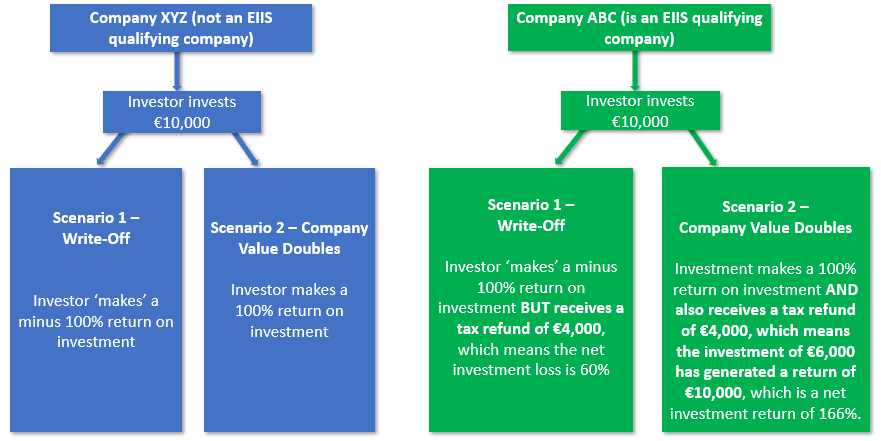

Investment Scenarios

Let’s take a look at a couple of investment scenarios, the first of which applies to a company that does not qualify for an EIIS tax refund and we then contrast the potential returns from this with a company that is an EIIS qualifying company. In each scenario, the company could return either nothing to the investor (i.e. a write-off) or the company could double in value (i.e. a 100% increase in value).

The difference between a return of 100% and 166% may not sound like an awful lot, as per the difference in investing in an EIIS qualified company and a non-EIIS qualified company in the examples above.

However, if you compound this over just 5 investments, a €10,000 investment in 5 non-EIIS companies delivers a return of €320,000, whereas an investment of €10,000 in 5 EIIS qualified companies delivers a return of €426,000, which highlights the advantages of investing in EIIS companies.

Most of the companies that raise funds on Spark Crowdfunding are EIIS approved companies. To receive regular notifications of EIIS investment opportunities straight to your inbox please register on the Spark Crowdfunding site for free by clicking below.