How to choose between 4 compellin...

By Chris Burge, CEO, Spark Venture Funding

Private market investing has never been short of opportunity,

but it has always been short of clarity.

At any given time, investors are presented with a wide range

of early-stage businesses, each claiming to be “high growth”, “disruptive”, or

“unique”. In reality, early-stage companies differ dramatically in terms

of risk profile, maturity, capital structure, tax efficiency, and

execution capability.

That is particularly true when investing through

EIIS-qualifying opportunities.

At the time of writing, Spark Venture Funding has four

live EIIS investment opportunities on the platform. All four are very

different businesses, operating in different sectors, at different stages of

development, with different funding histories and different EIIS

characteristics.

This article does not attempt to recommend one over another.

Instead, it sets out to do something much simpler, and,

hopefully, more useful.

Below, I outline:

- The background to

each company

- The key

characteristics of each investment opportunity

- The types

of investor objectives each opportunity may align with

The goal is to help investors understand how to

think about choosing between opportunities, not what to

choose.

Understanding EIIS Before Looking at the Companies

Before looking at the individual opportunities, it’s worth

briefly revisiting what differentiates EIIS investments from other forms of

private equity investing.

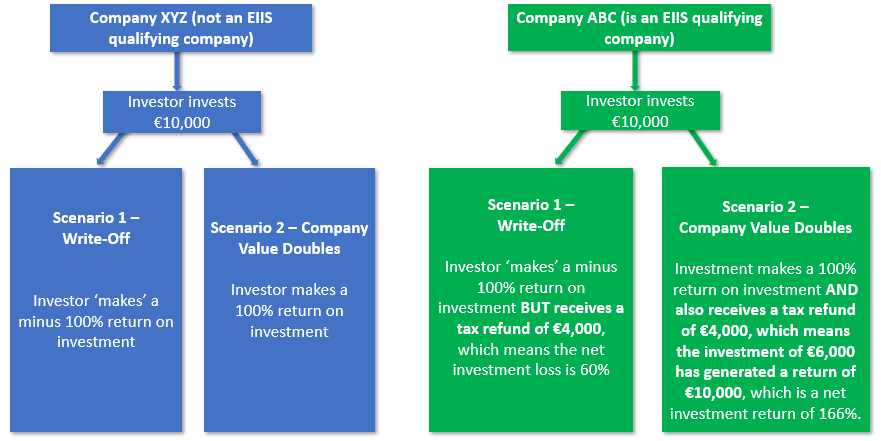

EIIS (Employment and Investment Incentive Scheme) allows

qualifying investors to claim income tax relief of up to 35% or 50%,

depending on the company and the structure of the investment.

That tax relief:

- Reduces

the effective cost of investing

- Alters

the risk-reward profile

- Can

materially affect the entry valuation at which an investor participates

However, EIIS relief is not uniform. Some companies

qualify for:

- 35%

EIIS

- 50%

EIIS (generally for earlier-stage, R&D-intensive companies)

The four live Spark campaigns span both EIIS bands,

which is one of the key differentiators between them.

Opportunity 1: Liltoda , Early-Stage Paediatric MedTech

with 35% EIIS

Company Overview

Liltoda is a Cork-based paediatric MedTech company that has

developed CogniTOT, a digital cognitive assessment platform for very young

children.

The company was spun out of University College Cork

(UCC) and the INFANT Research Centre, with the goal of addressing a

long-standing challenge in early childhood healthcare: identifying cognitive

and developmental difficulties before school age.

CogniTOT is a touch-screen, gamified assessment

tool that allows clinicians to objectively assess cognitive development in

toddlers without relying on language, parental reporting, or highly subjective

clinician interpretation.

Sector & Market

- Sector: Paediatric

MedTech / Digital Health

- Market

Focus: Early childhood cognitive assessment

- Geography: EU,

UK, US and non-English speaking markets

The combined EU, UK and US preschool screening market is

estimated to exceed €5 billion annually, with significant demand driven by

under-diagnosis of learning difficulties in early childhood.

Stage of Development

- Spin-out

from academic research

- Product

developed and clinically piloted

- Pre-scale

commercialisation phase

- Early

revenues with recurring SaaS-style potential

This is an early-stage MedTech company, still in the

process of transitioning from research validation to commercial rollout.

Technology & Validation

Key characteristics of CogniTOT include:

- Language-independent

testing

- Objective,

data-driven scoring

- Short

assessment time (15–20 minutes)

- Automated

clinical reporting

- Integration

potential with electronic health records

The platform has been:

- Clinically

validated across 12 investigations in 5 countries

- Used

by leading paediatric research institutions, including the NIH, Trinity

College Dublin and European clinical trial networks

- Supported

by patent applications in Europe and the US

Founding Team

Liltoda’s founding team is heavily weighted

toward clinical and academic expertise:

- CEO

is a Professor of Paediatrics with a PhD and extensive research

credentials

- CTO

brings health software and UX expertise

- Clinical

Research Lead has deep experience in paediatric trials and regulation

This is a research-led team, typical of university

spin-outs, with strong domain knowledge and growing commercial capability.

Funding & EIIS Characteristics

- EIIS

qualifying at 35%

- Enterprise

Ireland client

- Early

institutional validation

- Relatively

modest funding raised to date

- Pre-money

valuation reflects early commercial stage

Key Investment Characteristics (Summary)

- EIIS

rate: 35%

- Sector:

Paediatric MedTech/Digital Health

- Stage:

Early commercialisation

- Revenue:

Early recurring revenues projected

- Founder

profile: Academic/clinical

- Enterprise

Ireland backing: Yes

Opportunity 2: Embryomic , Advanced IVF MedTech with 50%

EIIS

Company Overview

Embryomic is a Dublin-based MedTech company operating in

the IVF and fertility treatment sector.

The company has developed PMT-BC, a proprietary

metabolomic test designed to identify the most viable IVF embryo for

implantation, non-invasively and with significantly improved success rates.

IVF success rates have remained stubbornly low for decades,

typically in the 25–30% range per cycle. Embryomic’s technology aims to

materially improve those outcomes.

Sector & Market

- Sector: IVF

/ Fertility MedTech

- Market

Focus: Embryo selection testing

- Geography: Europe

initially, with expansion planned

Over 1 million IVF cycles are performed annually

in Europe alone, representing millions of embryos evaluated each year.

Stage of Development

- 12+

years of research underpinning the technology

- Patents

granted in EU, UK and China

- Dedicated

research laboratory established

- Clinical

validation studies underway with major IVF clinic networks

This is a deep-tech MedTech company moving from

extended R&D into structured commercial deployment.

Technology & Validation

PMT-BC is based on:

- Mass

spectrometry (MALDI-ToF MS)

- Large

metabolomic datasets

- A

patented predictive algorithm

Key characteristics include:

- Non-invasive

testing

- Integration

with existing IVF lab workflows

- Probabilistic

scoring rather than binary decisions

Independent data indicates:

- 47%

higher transfer-to-pregnancy success rates compared to traditional

embryo selection tools

Founding Team

Embryomic’s team combines:

- Senior

commercial leadership

- World-leading

scientific expertise

- Deep

IVF industry experience

The CSO is a former university dean with extensive

proteomics expertise, supported by experienced clinical, financial and

fertility industry leaders.

This is a multi-PhD, domain-expert team, typical of

capital-intensive medical innovation.

Funding & EIIS Characteristics

- EIIS

qualifying at 50%

- Enterprise

Ireland client

- Significant

prior private investment

- Patents

represent substantial barrier to entry

- Pre-money

valuation reflects advanced IP and projected revenues

Key Investment Characteristics (Summary)

- EIIS

rate: 50%

- Sector:

IVF / Fertility MedTech

- Stage:

Late R&D / early commercial rollout

- Revenue:

Validation-stage, scaling planned

- Founder

profile: Deep scientific + commercial

- Enterprise

Ireland backing: Yes

Opportunity 3: OOHPod, Revenue-Generating Infrastructure

with 35% EIIS

Company Overview

OOHPod is an Irish parcel locker infrastructure company

founded by John Tuohy, a well-known figure in the logistics sector

with two previous successful exits (Parcel Motel and Nightline).

OOHPod operates a carrier-agnostic smart parcel locker

network, addressing inefficiencies in first- and last-mile parcel delivery.

Sector & Market

- Sector: Logistics

/ Infrastructure

- Market

Focus: Parcel lockers and last-mile delivery

- Geography: Ireland,

with UK expansion imminent

The parcel delivery market in Ireland and the UK is worth

almost €1.8 billion annually, with strong growth driven by e-commerce.

Stage of Development

- Trading

since 2022

- 200

locker locations live

- 30,000

subscribers

- Handling

~10,000 parcels per week

- Approaching

profitability

This is a growth-stage, revenue-generating business,

closer to private equity than early-stage venture.

Business Model & Validation

Key characteristics include:

- Carrier-agnostic

access

- 24/7

availability

- Lower

emissions vs home delivery

- Partnerships

with major retailers and carriers

OOHPod has already attracted almost €10 million in

institutional and angel investment.

Founding Team

- Founder

with decades of logistics experience

- Proven

track record of exits

- Experienced

COO, CTO and CFO

- Operationally

mature management team

This is an execution-led team, focused on scale,

profitability and infrastructure rollout.

Funding & EIIS Characteristics

- EIIS

qualifying at 35%

- Enterprise

Ireland client

- Significant

prior institutional investment

- Higher

valuation reflecting revenue base

Key Investment Characteristics (Summary)

- EIIS

rate: 35%

- Sector:

Logistics / Infrastructure

- Stage:

Growth / near-profitability

- Revenue:

Strong recurring revenues

- Founder

profile: Serial entrepreneur with exits

- Enterprise

Ireland backing: Yes

Opportunity 4: Quadrant Scientific, Wireless Medical

Navigation with 35% EIIS

Company Overview

Quadrant Scientific is a Cork-based MedTech engineering

company developing wireless electromagnetic navigation technology, often

described as “GPS for the body”.

Its DeepTrack system enables accurate navigation of medical

instruments beyond the line of sight, without reliance on X-ray or wired

sensors.

Sector & Market

- Sector: Medical

Devices / Surgical Navigation

- Market

Focus: Cardiology, bronchoscopy, ENT, robotics

- Geography: Global

OEM partnerships

The electromagnetic navigation sensor market alone is

estimated at €870 million, growing rapidly.

Stage of Development

- Generating

consultancy revenues

- OEM

partnerships established

- Patented

technology licensed from UCC

- Wireless

system successfully trialled

This is a commercialising deep-tech engineering

company, positioned for OEM acquisition.

Technology & Validation

Key differentiators include:

- Wireless

sensors

- Smaller,

cheaper hardware

- Reduced

operating theatre risk

- Faster,

more accurate navigation

Quadrant has:

- DTIF

grant funding

- Enterprise

Ireland HPSU investment

- Strategic

equity investment from a US sensor manufacturer

Founding Team

The team includes:

- Multiple

engineering PhDs

- Former

MIT and Imperial College researchers

- Commercial

leadership with med-device experience

This is a technical founder-led company, with strong

institutional validation.

Funding & EIIS Characteristics

- EIIS

qualifying at 35%

- Enterprise

Ireland client

- No

debt on balance sheet

- Valuation

underpinned by R&D investment and revenue projections

Key Investment Characteristics (Summary)

- EIIS

rate: 35%

- Sector:

Medical Devices / Engineering

- Stage:

Early commercial revenues

- Revenue:

Consultancy + OEM trajectory

- Founder

profile: Engineering PhDs

- Enterprise

Ireland backing: Yes

So How Might an Investor Think About Choosing?

All four opportunities are credible, but they

suit different investor objectives.

- If

you are seeking maximum EIIS relief (50%), exposure to deep

MedTech IP, and are comfortable with longer commercialisation

timelines, Embryomic may align with your criteria.

- If

you are looking for earlier-stage paediatric MedTech, with strong

academic validation and global SaaS potential, Liltoda presents a very

different risk-reward profile.

- If

your preference is for a more mature, revenue-generating business,

with an experienced founder and infrastructure-style characteristics,

OOHPod offers a fundamentally different exposure.

- If

you are attracted to engineering-led MedTech, with OEM acquisition

potential and strong institutional backing, Quadrant Scientific occupies a

distinct position.

Alternatively, some investors may choose to diversify

across all four, allocating capital evenly to build a balanced EIIS-backed

private market portfolio at no additional cost.

Final Thought

Early-stage investing is never about certainty, it is about

alignment.

Understanding what kind of risk, stage, sector, and tax

profile you are investing into is often more important than trying to pick

a single “winner”.

Clarity beats conviction.

Chris Burge is CEO of Spark Venture Funding, an equity

crowdfunding platform authorised by the Central Bank of Ireland, connecting

investors with high-potential private companies.

Irish Investors Flock to Spark Cr...

In recent years, Spark Crowdfunding has emerged as the ‘go to’ platform for Irish investors seeking high-growth opportunities in the Medtech sector. The platform has seen remarkable success with multiple Medtech companies raising substantial funds from a growing pool of intelligent investors.

Spark Crowdfunding provides Irish investors of all sizes with access to VC calibre investment opportunities that they previously could not access, and in amounts from as little as €100 per campaign up to €100,000. Investors pay no commission and most of the investment opportunities qualify for a 50% EIIS tax rebate.

Here is a selection of some of the most recent investment opportunities:

AuriGen Medical: A Galway-Based Success Story

One of the most notable success stories is AuriGen Medical, based in Galway, which raised an impressive €3.5 million over the course of 3 separate campaign from more than 700 investors through Spark Crowdfunding. AuriGen had previously raised over €20m in funding from sophisticated investors, such as WDC and Enterprise Ireland.

PumpInHeart: Treating Advanced Stage Diastolic Heart Failure

In June 2024, PumpInHeart attracted €852,000 from 258 investors. This early-stage Medtech company is a spin-out from the Royal College of Surgeons in Dublin and has shown that there is robust investor appetite for new medical innovations that promise to revolutionize patient care and improve health outcomes.

Altach BioMedical: Spinout from Trinity College Dublin

Altach BioMedical kicked off 2024 with a successful funding round, raising €1.1 million from 210 investors in January, as a collaborative effort between Spark Crowdfunding and NLC Ventures, the specialist Dutch VC. This funding is expected to accelerate their research and development efforts, with the objective to commercialize a collagen scaffold technology for cartilage repair

ATXA Therapeutics: Founded by UCD Professor

ATXA Therapeutics capped off 2023 by securing €2.7 million from 203 investors in December. The company had previously raised €15m and funds raised will be us to advance its new drugs as novel therapies for heart and lung diseases This significant funding round highlights the sustained interest and trust in the Medtech sector among Irish investors.

AVeta Medical: University of Galway Spinout

AVeta Medical has also made waves, raising over €1.1 million from 143 investors. AVeta has developed a technology to treat vaginal atrophy and had raised funding previously from European investors and Enterprise Ireland.

ProVascTec: UCC Spinout with an Outstanding Team

Most recently, ProVascTec launched a new equity fundraising campaign in July 2024 and has already raised €294,000 from 38 investors. The company has developed a novel mechanism for the efficient delivery of cell therapies for the treatment of patients suffering from blocked lower-leg arteries and has received funding from NLC Ventures and Enterprise Ireland.

Why Are These Campaigns So Successful?

One of the key reasons behind the success of these crowdfunding campaigns is the attractive 50% EIIS (Employment and Investment Incentive Scheme) tax rebate available to investors. This tax incentive significantly reduces the financial risk for investors, making Medtech investments through Spark Crowdfunding even more appealing. If you invest €10,000 in ProVascTec (above) for example, you receive a tax refund of €5,000, which cuts the risk of your investment in half.

Impressive Average Investment Size

The average investment size per investor on Spark Crowdfunding is approximately €5,000. This figure reflects a robust commitment from individual investors who are confident in the potential returns and the impact of their investments in the Medtech sector.

Conclusion

The surge in investment through Spark Crowdfunding highlights a growing trend among Irish investors who are increasingly drawn to the Medtech sector. With substantial funding rounds and the allure of tax incentives, platforms like Spark Crowdfunding are proving to be vital in supporting the growth and development of innovative medical technologies in Ireland. As more Medtech companies seek funding, it is clear that Spark Crowdfunding will continue to play a pivotal role in connecting visionary entrepreneurs with investors eager to make a difference in healthcare.

To access these investment opportunities, join Spark Crowdfunding today for free. It takes less than 2 minutes by clicking here: https://www.sparkcrowdfunding.com/register

Spark Crowdfunding Appoints Pat F...

[Dublin, 26 January 2024] – Spark Crowdfunding, a leading equity crowdfunding platform, is pleased to announce the appointment of Patrick Flynn as its new Chairman of the Board.

Patrick Flynn founded Flynn O’Driscoll, Business Lawyers in 2002. In 1983 he graduated with an honours BCL law degree from University College Dublin. He was admitted as a solicitor in Ireland in 1987 and in England and Wales in 1996. In 2013 he completed an Advanced Leadership Management Programme with the Timoney Institute which is associated with IESE Business School.

Pat previously worked with A&L Goodbody, one of Ireland’s largest law firms. He is a former senior executive of Ulster Investment Bank (part of the RBS/NatWest Group) where he specialised in global structured finance transactions involving European and US companies. He has also worked in corporate finance in Ireland and in emerging markets, particularly the former CIS countries, for a UK business. Pat was head of the corporate law department in a top 10 Dublin law firm before leaving to establish Flynn O’Driscoll.

Pat has, in over 35 years of business life, acquired considerable transactional experience in acting on corporate mergers, investments, acquisitions and financings. He is practical, with excellent business skills and he brings these, together with a wide range of friendships and business relationships to day to day problem solving for clients. Over the years he has advised companies and shareholders on wide ranging issues including disputes and is recognised as an excellent solutions driven lawyer.

He served on the Board of Directors of Enterprise Ireland for a four year term, 2014 - 2018. Enterprise Ireland is the Irish Government organisation responsible for the development and growth of Irish enterprises in world markets and is one of the biggest early stage venture capital businesses in the World. He served to June 2023 on the Executive Committees of the Law Exchange International, the International legal network of 34 global law firms comprising of 1,733 lawyers.

Pat Flynn stated, "I am honoured to join Spark Crowdfunding as Chairman of the Board. The company has already made remarkable strides in empowering start-ups and investors alike. I look forward to contributing to the next phase of the company’s growth and success."

Spark Crowdfunding’s CEO, Chris Burge, echoed this sentiment, expressing enthusiasm about the future under Pat Flynn's leadership. "Pat brings a fresh perspective and a deep understanding of our industry. His extensive background in the growth of early stage companies in Ireland aligns seamlessly with our commitment to fostering innovation and supporting entrepreneurial endeavours. His guidance will be invaluable as we continue to expand our platform and provide innovative solutions for both entrepreneurs and investors. Pat has an exemplary track record and brings a wealth of experience and strategic vision."

Having secured regulatory status from the Central Bank of Ireland in November, 2023, Spark Crowdfunding is poised for an exciting chapter under the stewardship of Pat Flynn. The entire team looks forward to working collaboratively to achieve new milestones and reinforce Spark Crowdfunding's position as a pioneering force in the investment crowdfunding sector.

Take your Pension or Portfolio to...

Fizzle sticks! There goes another billion dollar ‘unicorn’ I didn’t back. Sound familiar? This week’s news that Ireland’s Cubic Telecom has entered the ‘unicorn’ club thanks to a €473 million investment from Japan’s Softbank should focus financial planning minds. In particular, we should focus on two things very familiar to readers of these pages. Firstly, speed. The business world is moving faster and faster. Secondly, technologies are rapidly merging and compounding value.

Just over a year ago, Cubic Telecom was reporting annual sales(Sept 2022) of circa €30 million with its connectivity software installed in 10 million vehicles. Yep, €30 million not €300 million. So, what prompted Softbank to enter into discussions for a 51% stake purchase on a valuation multiple of 31x the previous year’s revenues? One could hazard a guess that speed of growth was one consideration, given installations of its software have ramped up to 450,000 vehicles per month and are expected to go ‘exponential’. Also, one suspects the compounding of a number of technologies is beginning to drive traction. Cubic is at the fortunate intersection of the Internet of Things(IoT), 5G connectivity, electric/battery powered vehicles (EVs), cloud computing and Artificial Intelligence(AI). We need to start thinking about multiple technologies compounding at speed rather than focusing on one technology advance, and it’s not just Ireland illustrating these two themes.

All the gloomy headlines this year have put us all in a strange place. And, awkwardly so for financial advisors who possibly went into ‘bunker’ mode. I have been asked to look at 3 different pensions in the last week where returns to date were hovering at just over 3%. That’s actually less than you’d earn on risk-free US Treasuries currently. However, the killer data point is that the tech-heavy index, the Nasdaq 100, is up 48% year-to-date. Oh, and despite all those war headlines and oil worries from Russia/Ukraine and the Middle-East, the energy sector is DOWN year-to-date. Even Germany which is staggering into recession boasts a stock-market (DAX) hitting all-time highs and returning 18% gains this year. Note, the DAX is definitely NOT filled with tech names. However, the Nasdaq is telling us lots of technology from energy storage(Tesla) to cloud(Microsoft) to AI(Google) are emerging at the same time. Just yesterday, Google showed us a new AI bot, Gemini, and its market value jumped by $85 billion over the day. That’s the equivalent of Citibank’s market capitalization after 211 years in existence. Just one day. It feels like wealth creation cycles are shrinking.

Latest reports suggest the AI team at French start-up, Mistral, are raising funds again. Recall that this crew of AI gurus raised over $100 million 6 months ago with no product, no business or revenues. Just a PowerPoint presentation deck. Now the team have a product (large language model(LLM) for Generative AI) and want to raise more than $300 million. The current valuation level for Mistral is ….. reported to be over $2 billion. Six months. However, before we go all dollars dreamy, note that the hard yards and years are still the norm. For example, Cubic Telecom started up back in 2005. At a higher level, consider it took Microsoft 44 years to hit the trillion dollar market value mark, Apple 42 years, Amazon 24 years and Google 21 years. Keep those tech and time thoughts and let’s move to the other end of the business life spectrum.

We have already referenced pensions, but for many investors these are vehicles for a variety of funds investing in a mix of blue chip publicly listed company shares and their debt(bonds), government bonds, possibly some real estate and a bit of cash. Given the fast-moving tech world we live in, it is increasingly apparent that investors’ pensions or savings portfolios should allocate a small portion of monies(5-10%) to early-stage companies. Pensions are not the ideal vehicle(for the majority of people) for these investments, but the good news is that the government provides incentives with a similarly attractive taxation impact.

For years, starting with BES schemes and then evolving into the current EIIS funding initiatives, government has encouraged private investor capital to support employment and growth for early-stage companies by offering tax rebates against income generated in the year of investment(s). That rate of rebate has been a standard 40% but is due to change. More on that later but first, let’s briefly explain the mechanics of EIIS.

If a company is eligible for EIIS investment it will typically be introduced to private investors in three ways. Note, not all companies qualify for EIIS treatment eg. financial trading businesses are not eligible. Companies which do qualify, offer shares through the following:

- Direct Investment: The investee company offers its shares directly to investors. These direct investment opportunities are typically offered to small groups of investors known to the company’s founders or its financial advisors, and not made public.

- EIIS Funds: These funds are managed by financial intermediaries/brokers and request lump sums up front from private investors. The capital raised is then deployed across EIIS investment opportunities. The up-front sums can be significant(> €10,000) and the managers will charge annual fees.

- CrowdFunding Platforms: A platform like Spark (or Seedrs or Crowdcube in UK) will give thousands of signed-up investors access to 12-15 fundraising campaigns by EIIS qualifying companies each year. The business model of these platforms is different to a fund. The investors do not pay any up-front lump sums or fees. Investors can invest as little as €250 in each EIIS investment with NO commissions, and NO management fees. Instead, Spark and other platforms only charge the companies a fee(and only if successful). One other variation on this is Angel Networks, or syndicates, which invest as opportunities arise. However, the entry level investment size (€5,000 – €10,000) and lead times are not for everyone.

So, after paying for your shares, those shares will sit in a broker account, or a fund, or in a nominee account(independent of platform). The company will then apply for EIIS certification from the Revenue. On receipt of this notification, investors will get a certification confirming same which can be filed with the Revenue to offset taxes paid in that year.

What sort of people could this interest? The income which qualifies for tax rebates includes employment income, rental income, dividends and ARF distributions. The amount of income which can avail of EIIS has been increased from €250,000 to €500,000 in a single year under new rules to come into effect in January 2024. Also, note the investment must be for a minimum of 4 years. The new rules in the Finance Bill also have broken the standard 40% rebate rate into different bands which we have summarised in a previous article as follows:

- 50% for businesses that ‘have not operated in any market’;

- 35% for a business in its first EIIS fundraise within 7 years of its first sale;

- 20% for a business in its second or subsequent EIIS fundraise;

- 20% for a business expanding into new markets or regions; and

- 30% for investments via a ‘Qualifying Investment Fund’, of which there is only one in Ireland.

Quite apart from introducing potential confusion, the ‘core’ or standard EIIS rebate of an equity investment will now be reduced from 40% to 35%. On a more positive note, the 50% relief for early-stage pre-operating companies could be very interesting for Ireland and Irish investors. It won’t have escaped your attention that the trillion dollar tech club is entirely US based. That can be attributed to deeper capital markets and Silicon Valley tech leadership but could Ireland be a leader now? I’m thinking three big areas where the Irish ecosystem is quietly building real scale and a pipeline of early-stage opportunities. Here we go:

Medical Technology/Bio-pharma: 14 of the 15 biggest MedTech players have significant operations including critical R&D functions in Ireland. Also, 12 of the biggest global pharma players are there too. That ecosystem is beginning to deliver a fly-wheel effect of training, management, success, entrepreneurial juices and world-class innovation.

Cleantech: Irish engineering and construction companies are already leveraging their experience of executing huge hi-spec projects for tech giants like Microsoft and Intel, and global life sciences companies. These Irish companies are now key players in the build-out of EV battery gigafactories, data centres, clean energy manufacturing plants, pharmaceutical plants and chip manufacturing facilities all over the world. It is highly likely this hi-tech project expertise will generate new innovations and young companies to drive the cleantech revolution.

Artificial Intelligence(AI): The creator economy is a $250 billion monster with all the major players from Google to LinkedIn to Meta/Facebook positioning their European HQs in Ireland. It is clear the creator economy is in the cross-hairs of AI and one can expect the Silicon Docks of Dublin to spin out a number of AI innovations. In fact, Spark will be bringing an exciting AI play to investors very soon.

Furthermore, or a bit further afield, we should note interesting developments in Europe. Spark as a newly regulated entity with EU ‘passport’ will be looking at potential investment opportunities and encouraged by the latest data from Atomico’s “State of European Tech 2023” report:

- Investment levels in European tech has reached $45 billion which is up 18% on 2020. Every other region is down over the same period.

- Europe’s talent pool has grown from 750,000 to 2.3 million in the last 5 years. And, in 2023 Europe was a net beneficiary of people moving from the US to Europe. How Trumpy….

- Europe now has 4,000 growth stage tech companies.

- Europe (not just Mistral) can compete in AI globally. In fact, Europe has more resident AI talent than the US (120k vs 112k).

There will be early stage investment opportunities in a faster world. And, frankly, waiting for IPOs could be a long way off. Thanks to huge private investment pools, companies like Stripe, Shein and OpenAI can stay private for longer, or forever. In the US alone, 70% of early stage/VC funding comes from pension funds and educational endowments. Europe has a bit of catching up to do; only 20% of funding comes from institutional sources. But….. on a contrarian view, this presents an opportunity for European and Irish private/individual capital to step into the gap and seize opportunities that typically might have gone straight to institutional/professional players. So, instead of fizzle sticks maybe think about sticking some funds into one of the EIIS access vehicles referenced above. As always, we recommend a portfolio-building approach, spreading your risk in smaller amounts across 8-10 investments per year. See the table below as a quick summary of what might work for you:

Finally, if it’s speed and technology you’re looking for, then a 3-minute sign up process on the Spark platform is a pretty slick start to your early-stage investing journey.

First Investment Bonus Offer

Terms and Conditions – First Investment Bonus Offer

These terms and conditions ("Terms") apply to the Investor Bonus Shares Offer ("Offer") provided by Slua Ventures, trading as Spark Crowdfunding, a private entity incorporated under the laws of Ireland.

1. Eligibility:

· The Offer is open to private investors aged 18 years and above.

2. Offer Period:

· The Offer is valid from 30 November 2023 to 31 August 2024.

3. Bonus Amount:

· Investors participating in the Offer will receive bonus shares of €250 after their first investment on the Spark Crowdfunding platform, subject to a minimum investment of €1,000.

· The bonus shares will be credited to the investor's account within 14 days after the first investment.

4. Investment Limits:

· The minimum investment amount to qualify for the bonus shares is €1,000.

· There is no maximum limit for the investment amount eligible for the bonus shares, but the maximum bonus is €250 worth of shares in the qualifying company.

5. Bonus Share Disbursement:

· The bonus shares will be disbursed in the form of shares credited to the investor's account.

· The bonus shares are non-transferable and non-refundable.

6. Rights and Restrictions:

· Bonus shares entitle investors to additional shares and voting rights.

· Bonus shares may be subject to tax implications, and investors are encouraged to seek independent tax advice.

7. Refund Policy:

· All investments made during the Offer Period are final, and no refunds will be issued.

8. Offer Amendments:

· Spark Crowdfunding reserves the right to amend or terminate the Offer at any time without prior notice.

9. Governing Law:

· These Terms are governed by the laws of Ireland, and any disputes will be subject to the exclusive jurisdiction of the courts in Ireland.

10. Acceptance of Terms:

· By participating in the Offer, investors agree to be bound by these Terms and any additional terms and conditions provided by Spark Crowdfunding.

11. Contact Information:

· For inquiries or assistance related to the Offer, please contact Karl McLauglin at karl@sparkcrowdfunding.com

10% Share Bonus Offer – Explana...

The 10% Share Bonus Offer rewards the first 25 investors in a new equity crowdfunding campaign with bonus shares in the company raising funds.

For example, if you decide to invest €1,000 in Altach BioMedical and their share price is (say) €4 you would ordinarily receive 250 shares.

With the 10% Share Bonus Offer, you would receive an additional 25 shares at no cost to you.

In total therefore, you would receive 275 shares for your investment of €1,000.

The maximum ‘value’ of the bonus shares per investor is €500. To receive this maximum of €500 you would need to invest €5,000, and any amount above €5,000 you invest would not qualify for any additional bonus shares.

The following Terms & Conditions apply to this 10% Bonus Offer:

Terms and Conditions - Investor Bonus Shares Offer

These terms and conditions ("Terms") apply to the Investor Bonus Shares Offer ("Offer") provided by Slua Ventures, t/a Spark Crowdfunding, a private entity incorporated under the laws of the Republic of Ireland.

1. Eligibility:

- The Offer is open to private investors aged 18 years and above. Investments must be made on the Spark Crowdfunding platform within 24 hours of the campaign launch email pertinent to the campaign offer.

2. Offer Period:

- The Offer is valid from 1st October 2025 to 31st December 2025.

3. Bonus Shares Calculation:

- Investors participating in the Offer will receive a bonus equal to 10% of the invested amount in the form of additional shares.

- The bonus shares will be calculated based on the total investment amount during the Offer Period.

4. Investment Limits:

- The minimum investment amount to qualify for the Offer is €100.

- There is no maximum limit for the investment amount eligible for the bonus shares, but the maximum bonus amount per investor is €500 worth of shares.

5. Bonus Shares Allocation:

- Bonus shares will be allocated within 14 days after the completion of the Offer Period.

- The allocation will be based on the closing date valuation of the company.

6. Company Eligibility:

- Bonus shares may only be issued in the same company in which the investment was made.

7. Rights and Restrictions:

- Bonus shares carry the same rights and restrictions as regular shares issued by the company.

- Investors will have the right to dividends and voting rights associated with the bonus shares.

8. Refund Policy:

- All investments made during the Offer Period are final, and no refunds will be issued.

9. Offer Amendments:

- Spark Crowdfunding reserves the right to amend or terminate the Offer at any time without prior notice.

10. Governing Law:

- These Terms are governed by the laws of the Republic of Ireland, and any disputes will be subject to the exclusive jurisdiction of the courts in the Republic of Ireland.

11. Acceptance of Terms:

- By participating in the Offer, investors agree to be bound by these Terms and any additional terms and conditions provided by Spark Crowdfunding.

12. Contact Information:

- For inquiries or assistance related to the Offer, please contact Karl McLaughlin at karl@sparkcrowdfunding.com

Spark Crowdfunding Achieves Regul...

10th November 2023

Spark Crowdfunding, Ireland’s leading player in the equity crowdfunding space, proudly announces that it has attained regulatory status from the Central Bank of Ireland. This milestone marks a significant step forward in the company's mission to provide a secure and transparent platform for private investors and entrepreneurs alike.

The regulatory status granted by the Central Bank of Ireland underscores Spark Crowdfunding's commitment to operating with the highest standards of integrity and compliance within the dynamic financial services landscape.

Equity crowdfunding platforms play a vital role in democratising access to investment opportunities, allowing a broader audience to participate in the growth of innovative businesses. The regulatory approval from the Central Bank of Ireland positions Spark Crowdfunding as a trusted and regulated entity, instilling confidence in both investors and entrepreneurs engaging with the platform.

Chris Burge, CEO of Spark Crowdfunding, stated:

"We are pleased to announce that Spark Crowdfunding has achieved regulatory status from the Central Bank of Ireland. This regulatory approval is a testament to our unwavering commitment to the highest standards of security, and compliance. We believe in fostering an environment where astute private investors can confidently support highly scalable ventures, and entrepreneurs can access the capital they need to accelerate their growth rates. The timing of this regulatory approval is really important as the environment for Irish companies looking to raise up to €3m is becoming increasingly difficult. We have an active and growing database of 11,500 private investors in Ireland who are keen to invest in exclusive investment opportunities only available on the Spark Crowdfunding platform, opportunities that would previously have only been available to Venture Capitalists. Our average investment amount is €4,000 and most of our investment opportunities qualify for a 40% EIIS tax refund."

About Spark Crowdfunding:

Established in Dublin in 2018, Spark Crowdfunding is a leading equity crowdfunding platform dedicated to connecting visionary entrepreneurs with astute private investors. By facilitating the exchange of ideas and capital, Spark Crowdfunding empowers the growth of innovative businesses across various industries. The company has raised funds for 42 Irish based companies over the past 5 years across a range of sectors, including Med-tech, Pharma, Fin-tech and Mobility. The average campaign size is roughly €600,000. In December 2023, Spark Crowdfunding raised €1.5m for the Galway med-tech company AuriGen Medical from 275 private investors in 18 days. In July of this year, AuriGen Medical raised a further €1.9m from 200 private investors on the Spark Crowdfunding platform. With regulatory status from the Central Bank of Ireland, Spark Crowdfunding is poised to lead the way in shaping the future of equity crowdfunding in Ireland.

What do Irish private investors l...

At Spark Crowdfunding, we have analysed the behaviour of over 11,000 private investors in Ireland across 40 fundraising campaigns and thousands of individual investments from €100 to €100,000.

These investors carefully evaluate numerous factors before deciding how to invest their capital. If you are a private individual who is considering investing in early-stage companies you may be interested to know how other private investors assess investment opportunities.

Alternatively, if you're an entrepreneur seeking funding, it's essential to understand what private investors prioritise when considering an investment.

Here are the seven most important things that private investors look for in a start-up:

1. Strong and Committed Team:

A start-up's success hinges on the capabilities and dedication of its team. Private investors look for founders and team members who possess relevant skills, experience, and a deep commitment to the company's mission. A diverse team with complementary strengths is viewed positively and is generally considered the single most important factor in an investment decision.

2. Market Potential:

Investors want to see a sizable and growing market for the product or service the start-up offers. Thorough market research and a clear understanding of the target audience's needs and preferences are crucial. Investors need to be convinced that there is a genuine demand for what the start-up is offering.

3. Unique Value Proposition:

What sets the start-up apart from competitors? Investors seek businesses with a unique value proposition or a competitive advantage. This could be in the form of innovative technology, a patented product, a disruptive business model, or a superior customer experience.

4. Traction and Milestones:

Demonstrating that the start-up has made progress is vital. Investors want to see evidence of customer acquisition, revenue generation, or partnerships that validate the business concept. Achieving milestones and hitting key performance indicators (KPIs) instill confidence as they are evidence of the delivery capability of the founding team.

5. Clear Business Plan and Strategy:

Investors need to understand how the start-up plans to reach its goals. A well-thought-out business plan and a clear growth strategy are essential. This should encompass marketing, sales, distribution, and financial projections. If a start-up cannot clearly articulate its plans when raising funds, it is unlikely to be able to properly articulate the benefits of its products to its customers.

6. Scalability:

Private investors are often looking for opportunities to achieve a significant return on their investment. Scalability is crucial. Investors want to know that the start-up can grow rapidly without proportionally increasing costs. Scalable businesses have the potential to deliver substantial returns.

7. Exit Strategy:

Investors eventually want to see a return on their investment, and they look for an exit strategy. This could involve an acquisition by a larger company, an initial public offering (IPO), or other means of liquidity. A clear and viable exit plan is essential for investors' confidence.

If you would like to see evidence of a company that scored highly on all of the above and raised over €1 million from almost 200 private investors on the Spark Crowdfunding platform, we would recommend the AuriGen medical campaign, a Galway-based medical devices company: https://www.sparkcrowdfunding.com/campaign.php/aurigenmedical2

In addition to these seven factors, private investors also consider the industry landscape, the competitive landscape, and the overall economic climate. It's important for entrepreneurs seeking investment to not only have a compelling business proposition but also to be prepared to communicate their vision, achievements, and plans effectively.

In conclusion, private investors are on the lookout for start-ups that exhibit a combination of a strong team, market potential, uniqueness, traction, strategic planning, scalability, and a clear exit strategy. By selecting companies that demonstrate these key criteria, private investors can increase their chances of identifying investment opportunities that have potential to deliver high returns.

Spark Crowdfunding offers private investors 10-12 investment opportunities per annum in carefully selected companies that typically demonstrate the 7 factors above. Most of these investment opportunities are in EIIS qualifying companies, which means private investors can recover 40% of the value of their investment in the form of a tax rebate. Investors pay no commission on the Spark Crowdfunding platform and it is free to join.

But remember, investing in early-stage companies is high-risk. Only invest with money you can afford to lose.

Look Up!!

What if we told you there’s a business sector which was valued at $2.96 billion in 2022 but which will grow to over $20 billion by 2029? Wowzers, 32% compound annual growth (CAGR)!! You might think it’s that hot artificial intelligence (AI) stuff but it’s not. (Source: Fortune Business Insights)

What if we told you it’s a business where 50% of it’s key personnel will have retired in the next 15 years? Nope, it’s not a Premier League football club.(Source: US Global Investors).

What if the biggest manufacturing company in the sector thinks 790,000 of these key personnel will be needed globally? (Source: Reuters)

Would you be surprised to hear recent pay deals concluded with these key employees in the US market resulted in a whopping 46% pay rise? (Source: Bloomberg)

If this business is a mission-critical service to a global industry estimated to spend $15 trillion per annum in the next ten years (Source:WTCC) you’d think there would be monster amounts of money being thrown at this opportunity? But you’d be wrong…

The airline business has never been blessed with big cash piles and most of its investment is committed to new aircraft and IT systems. However, the shortage of pilots is becoming a major global problem and, in Europe alone, the shortfall will be a whopping 42,000 pilots by 2027. As an illustration of the limited firepower of airlines, check out recent announcements by BA and Aer Lingus to on-board 150 candidates for pilot training. One…hundred…and…fifty pilots. Now, consider that BA and Aer Lingus combined have almost 5,000 pilots on their roster. These initiatives won’t even meet existing rates of attrition. And, that’s before US airlines and others start poaching talent.

So, if you’re a well connected manager of a training platform for pilots on track to deliver 2,500 commercial pilots by 2027 and generate revenues of over €6m per annum, what’s that worth to the industry and investors? Let’s go back to that 32% annual growth rate to 2029 (CAGR) referenced by Fortune Business.

With those levels of revenues and profit margins over 30%, a platform (like Pilot Path) would be valued at well over €25 million. Now, consider the opportunity to buy into the Pilot Path business as an investor with an entry valuation of €3 million, or a tantalising €1.8m after EIIS rebate. Then, before you think about 14-15x returns on your investment, check out the following headlines screaming big problem……. and big big opportunity.

Some recent headlines:

- Pilot Training Market to Hit $20.21 Billion by 2029 | At a CAGR of 31.55% - Fortune

- American Airlines pilots approve new contract that boosts compensation by more than 46% - Reuters

- The global pilot shortage is a challenge to the world's airlines - CAPA

- Boeing Forecasts 20-Year Demand For 2.3M Pilots, Technicians, Crew

- Texas-based American Airlines grounding 150 planes due to pilot shortage

- Travel Will Represent a $15.5 Trillion Economy by 2033 - Bloomberg

- Portuguese Flight School, Sevenair Academy, Completes Acquisition of Flight School and Expands Maintenance Capabilities

- Skyborne Aviation Group Completes Acquisition of Vero Beach Flight Academy, Florida

- American Airlines boosts pilot contract offer by $1 billion after United deal

Binarii Labs

Binarii

Labs is raising funds on the Spark platform at a valuation of €6.7m and the

campaign has already raised over €1m in its first 2 weeks.

The company has just received confirmation that EIT, the prestigious

Brussels-based European Institute of Innovation and Technology, has agreed to

invest €400,000 in the company at a valuation of €20m.

Binarii Labs has been selected as one of only 8 businesses across Europe chosen

to be supported by EIT Digital in their much coveted EIT Digital Open

Innovation Factory programme which also provides funding of €400k from the

European Innovation fund.

This €20m valuation at which the European Innovation Fund is investing

contrasts with a valuation of €6.7m at which Spark investors can invest in this

current round. Spark

investors are therefore investing at a 67% discount to the valuation at which

the European Innovation Fund is investing.

And, if we apply the 40% EIIS tax refund, the valuation at which Spark

investors are investing today is actually €4.02m, which is an 80% discount to

the valuation at which the European Innovation Fund is

investing.

EIT Digital invests in strategic areas to accelerate the market uptake and

scaling of research-based digital technologies (deep tech) focusing on Europe's

key societal challenges: Digital Tech, Digital Cities, Digital Industry,

Digital Wellbeing, and Digital Finance.

The EIT Digital Open Innovation Factory programme focuses entirely on

supporting Binarii Labs in commercialising their innovative US patented and UK

patent pending Binarii DMS product that has already engaged lead clients whose

involvement in implementing the most complete market ready BinariiDMS possible

over the next 6 months will be supported by EIT Digital. Binarii Labs is

pleased to reveal that one of their key lead clients in the legal sector is

commercial corporate law specialist firm in Dublin, Sherwin O’Riordan

solicitors.

Further information on this EIIS investment opportunity and the link to invest

may be found here: https://www.sparkcrowdfunding.com/campaign.php/binariilabs

Spark investors record 429% incre...

In December 2020 Spark Crowdfunding investors invested over €790,000 in Moby at a share price of €0.24. Last week, Moby raised new funds at a share price of €1.27.

This represents a 429% increase in the value of the investment in Moby since 2020. When you include the EIIS tax refund that most Spark investors would have received with this investment, it actually translates into a 780% increase in the value of the investment.

Further information about this is contained in this article by Caoimhe Gordon in the Irish Independent here:

To make sure that you don't miss out on future opportunities, why not join Spark for free to access Exclusive Investment Opportunities like this.

Register here .... it takes less than 2 minutes

______________________

Moby Bikes raises €4m for Central Europe push

by: Caoimhe Gordon

Irish Independent

April 07 2023 02:00 PM

Irish company Moby Bikes has raised €4m in funding as it plots further international expansion.

The business, which first launched in Dublin in early 2020, now has operational bases in the UK, the Netherlands and the USA.

It currently has a fleet of over 4,000 e-bikes, e-cargo bikes and electric assisted vehicles.

Moby provides bike sharing schemes in Dublin, Athlone, Mullingar and Tullamore, as well as e-bikes for food delivery drivers, an initiative introduced over the pandemic. It has also developed an electric city bike monthly subscription scheme.

Moby also works with businesses, running a bike sharing scheme at Eastpoint Business Park in Dublin. And it operates ESB e-bikes in a number of locations around the city.

The new funding will be used to accelerate the company’s growth across central Europe, particularly in the areas of last-mile delivery, corporate markets and hotels.

The company reported that it has recently increased the headcount of its local management and sales teams in this region. Moby said new investment will see it expand its bike sharing schemes in Ireland, in locations where it is “profitable to do so”.

New technology, which will focus on app-less rental and new charging opportunities for customers, is a further focus for the group this year.

“This funding is indicative of the investor confidence in our success to date and the large market opportunity we have as city transportation habits continue to shift towards electric bikes,” founder and chief executive Thomas O’Connell said. “Today we are one of the few micro-mobility companies in the world that are actually profitable,” he added.

The funding round was led by Selenean Capital, with participation from Irish investors including Brian Caulfield.

“As the world continues to prioritise sustainable transportation, Moby is well-positioned to lead the charge with their innovative technology and dedication to providing reliable, eco-friendly solutions to businesses,” Selenean Capital chief executive Davin Browne said.

This investment follows a previous €1.2m seed round which took place in late 2020.

At the time, Moby raised €800,000 via Spark Crowdfundinging, as well as a combination of debt and asset finance alongside some individual investors.

Beginners Guide to Valuing a Star...

Beginners Guide to Valuing a Start-up Business

Valuing a startup is a complex process that requires a combination of financial analysis and business strategy analysis. There are several methods that can be used to determine the value of a startup, and the choice of method will depend on the company's stage of development, the data available, and the purpose of the valuation.

Pre-revenue valuation: In the early stages of a startup, there is often little to no revenue, making it difficult to use traditional financial metrics like earnings and revenue to value the company. In these cases, investors and analysts may use a combination of the following methods:

Comparables method: This involves comparing the startup to similar companies in the same industry or stage of development, and using the valuation of these companies as a basis for the startup's valuation.

Cost method: This method involves estimating the cost of developing the company's product or service and adding a markup to reflect the perceived market value.

Option pricing method: This method is based on the idea that a startup's equity is similar to an option, with a potential for significant future growth. The value of the option is based on the expected future growth of the company and the risk involved.

Post-revenue valuation: Once a startup has started generating revenue, traditional financial metrics can be used to value the company. The most common methods used are:

Discounted cash flow (DCF) method: This method involves projecting the future cash flows of the company and discounting them back to the present to determine the present value. The discount rate is based on the risk involved and the company's cost of capital.

Price to earnings (P/E) ratio: This method involves dividing the market value of the company by its earnings per share. This ratio can be used to compare the startup's valuation to other companies in the same industry or sector.

Price to sales (P/S) ratio: This method involves dividing the market value of the company by its revenue per share. This ratio can be used to compare the startup's valuation to other companies in the same industry or sector.

Valuation multiples: Another method used to value startups is to use valuation multiples, which are derived from the financial metrics of similar companies. These multiples can include price to earnings, price to sales, price to book value, and more. The multiple is applied to the financial metric of the startup to determine its value.

Regardless of the method used, it is important to keep in mind that the valuation of a startup is not an exact science, and there will always be a certain degree of uncertainty and subjectivity involved. It is also important to remember that the value of a startup can change rapidly, as the company evolves and its financial performance changes.

In conclusion, valuing a startup is a complex process that requires a combination of financial analysis and business strategy analysis. There are several methods that can be used to determine the value of a startup, and the choice of method will depend on the company's stage of development, the data available, and the purpose of the valuation. However, it is important to remember that the valuation of a startup is not an exact science, and there will always be a certain degree of uncertainty and subjectivity involved.

ASX to raise €750,000 to accele...

ASX to raise €750,000 on the Spark Crowdfunding platform to accelerate growth in the USA

Following its hugely successful equity crowdfunding campaign in May 2021, in which it raised over €500,000 in 24 hours, ASX Sports, co-founded by eponymous bookmaker Paddy Power, has launched a new €750,000 crowdfunding campaign. Watch the campaign video here: ASX link

The funds are being raised using a SAFE (which stands for Simple Agreement for Future Equity) instrument, in which the share price is not fixed today, but instead is determined when the company raises funds again in the future. In the case of this SAFE, existing investors in ASX will receive a 33% discount on the share price at the next round, which is expected to be within the next 6-9 months.

So, for example, if the share price at the next round is €1, those who invest in the SAFE today will purchase shares at a 33% discount to this €1 share price, which equates to a share price of €0.67. Therefore, instead of receiving 1,000 shares for a €1,000 investment, the investor would receive 1,492 shares for their €1,000 investment. Another way to think about this is that the investor is getting an extra (or bonus of) 49% worth of shares.

Please contact us if you require any clarification about the way in which a SAFE operates.

In total, ASX raised €2.2m from over 800 investors on the Spark Crowdfunding platform within a month.

To coincide with the crowdfunding campaign, ASX Sports today launched its new peer to peer contests, making it the first fantasy sports platform in the world to have fan contests running LIVE during games.

The technology allows players to create their own contests, and play against friends and fellow players for real money or sportzcoins. It will also enable sporting celebrities, eSports gamers and social media influencers to monetise their own followers and streamers via the gaming platform.

ASX Sports recently rolled out real money cash games to the U.S. market, allowing residents of 23 U.S. states to stake dollars to enter paid games for cash prizes. This was a significant milestone, enabling ASX Sports to accept eCommerce transactions on their platform.

Paddy Power, President at ASX Sports said: “The launch of peer-to-peer games on ASX demonstrates our dedication to driving innovation in the fantasy sports market. It comes at a time when our beta app has been installed more than 20,000 times, with over 30,000 contest entries across 10 of the biggest sporting leagues and competitions in the world including the NFL, NBA, EPL, MLB and the Six Nations. In addition, our app has been ranked in the top 100 sports apps in 11 different countries now, including The United States, Ireland and South Africa. On top of this, SportsPro Media named ASX among the 20 sports tech start-ups to invest in for 2022.”

Paddy continues “The launch of our 'Stocks for Sports' Index games for NFL, Premier League and Rugby in Q3 will provide real growth in our revenue and position ASX Sports for a major fundraising exercise in the coming months.”

Full details on the campaign may be found here: ASX link

How I Made a 650% Return on my In...

If you don’t have time to read the full article, here is the summary version:

In May 2019, I invested €5,000 in an Irish telemedicine company called Wellola that was raising funds on the Spark Crowdfunding platform. The Wellola share price at that time was €7.99.

In June 2022, Wellola announced that they had secured investment from the Venture Capital firm BVP at a share price of €36.76. This represented a 350% increase in the value of my shares.

However, Wellola is an EIIS qualifying company, which means private investors in Ireland can reclaim 40% of the value of their investment in the form of a tax refund. I therefore received a tax refund of €2,000, which means my actual investment was only €3,000, not the original €5,000 that I invested.

The value of my actual investment of €3,000 is now worth €23,000, which is an increase of over 650% in 3 years.

Background

Spark Crowdfunding is an equity investment platform which makes it easy for small and medium sized investors to buy shares in private companies which have high growth potential.

Founded in 2018 and based in Dublin, Spark Crowdfunding has a database of almost 10,000 private investors in Ireland. Over the last 4 years, these investors have invested in 28 Irish companies on the Spark Crowdfunding platform. Of these 28 companies, 20 also received investment funding from Enterprise Ireland, which has strict criteria for the type of company in which they invest.

Profile of Investors

Equity (or investment) crowdfunding gives small to medium sized private investors the opportunity to invest in companies that previously only Venture Capital firms or Enterprise Ireland could invest in. Investors can invest as little as €100 in a company and the average investment amount is about €2,800.

Many investors adopt a ‘portfolio approach’ to investing in early-stage companies. Instead of trying to pick specific winners, they invest a similar amount in every campaign, therein diversifying their risk, but also ensuring they don’t miss out on the one that delivers supernormal returns.

How EIIS greatly enhances returns for Irish investors

As the Wellola example at the beginning explains, the 40% tax refund on most of the companies in which private investors can invest on the Spark Crowdfunding platform magnifies the return on an investment of this nature. On the other hand, it also greatly reduces the maximum amount you can lose. With most investments you can lose 100%, but by investing in an EIIS qualifying company, the most you can lose is 60% of your investment.

How to Invest

If you are a private investor with anything from €100 upwards to invest in high potential Irish start-ups, equity crowdfunding is the easiest, quickest and least expensive way to take your first steps. You can open an account for free on the Spark Crowdfunding platform in minutes and review the various investment opportunities on offer. Click here to join for free: https://www.sparkcrowdfunding.com/

Regular webinars will allow you to hear directly from the CEOs of companies raising funds before you make a final decision to invest.

No Commission

One of the unique advantages of investing through equity crowdfunding is that investors pay absolutely no commission when they purchase shares in a company. 100% of the amount you invest goes into the purchase of shares in the company. In the long term and if you do a lot of investing, this can add up to a huge saving and greatly increase the value of your investment portfolio, no matter how large or small it is.

To open an account (for free) and invest in high growth Irish companies from as little as €100, join 10,000 other Irish investors on Spark Crowdfunding here:

Spark Investors Celebrate 88% Inc...

Equity crowdfunding enables small and medium-sized investors to buy shares in early-stage companies on the same terms as large Venture Capital or Private Equity firms. Gone are the days when private investors needed to have a minimum of €500,000 before they could get access to start-ups with high growth potential.

With Spark Crowdfunding, Ireland’s only equity crowdfunding service, Irish investors can invest from as little as €100 in Irish start-ups. While this low entry level of just €100 makes these investment opportunities accessible to almost everyone, the average investment amount made by an investor on the Spark Crowdfunding platform is actually €2,300.

Most of these investment opportunities are what’s known as EIIS qualifying, which means Irish Taxpayers can recover 40% of the amount they invest as part of their tax returns. So, for example, if you invested €1,000 in one of these companies, you would receive a Tax Rebate the following year of €400, regardless of how the investment performs. In effect, this means that the maximum you can lose is 60% of your investment.

Click here if you would like to join over 8,000 Irish investors and get access to investment opportunities like these: https://www.sparkcrowdfunding.com/register

Busterbox raises new funds at an 88% increase on last year’s valuation

One such investment opportunity on the Spark Crowdfunding platform in the Summer of 2020 offered investors shares in a Dublin-based company called Busterbox, which is a Dog Subscription Box service. Every month, thousands of dog owners pay approximately €20 to have a box containing treats for their dog delivered directly to their house. The business was growing rapidly before Covid but experienced a boom in activity when more people were spending time at home with their pets.

Busterbox raised funds from 82 Irish investors on the Spark Crowdfunding platform in September 2020 at a share price of €1. Such was the growth in the business over the next 12 months that a significant industry partner invested €250,000 in Busterbox at a share price of €1.88.

This translates into an 88% increase in the value of an investment in Busterbox just 12 months previously. But, when you include the 40% EIIS Tax Refund the return on investment over this 12 month period is significantly higher.

In simple terms, if you had invested €10,000 in Busterbox, it would really only have cost you €6,000, and the value of your investment is now worth €18,800. An increase in value from €6,000 to €18,800 is actually a 213% increase in investment. (Do the Maths!!)

What’s more, investors on the Spark Crowdfunding platform pay 0% commission when purchasing shares. There are no hidden costs and it’s free to open an account.

Over the last 3 years, Spark Crowdfunding has offered 26 investment opportunities to Irish investors.

If you are interested in signing up as an investor with Spark, click below:

2 Live EIIS Investment Opportunit...

2 Live EIIS Investment Opportunities for Irish Investors in exciting Irish Start-ups

Would you like to invest in a high-growth Irish company in which TWO leading Irish Venture Capital firms are also investing? If so, you may be interested in finding out more about ClarityCX1, which is one of 2 campaigns open for investment on this platform.

Irish investors can access 2 live investment opportunities in Irish start-ups on the Spark Crowdfunding platform. Click here to view these investment opportunities: https://www.sparkcrowdfunding.com/

Each of these carefully selected investment opportunities qualify for a 40% tax refund via the EIIS scheme designed to encourage investment in Irish early-stage ventures. This means that a €1,000 investment only costs €600 as the investor can reclaim €400 in the form of a tax refund.

Furthermore, investors pay No Commission when investing in companies on the Spark Crowdfunding platform. The minimum investment size is just €100.

Further information about these live investment opportunities may be found here:

ClarityCX1: https://www.sparkcrowdfunding.com/campaign/claritycx1

ClarityCX1 is a Customer Relations Management (CRM) software business that is targeting the Pharmaceutical and Life Sciences industries. Led by Chris Deren, who has 30+ years in this industry, the company has managed to secure investment from two leading Venture Capital firms in Dublin as part of this fundraising round. It is also hoping to secure a sizeable investment from Enterprise Ireland at this time. To view the campaign video and learn more about this investment opportunity, please click here.

Please note that only registered investors of Spark Crowdfunding may view the full details of the campaign, but it takes less than two minutes to join Spark Crowdfunding and it’s free, with no obligation to invest. Click here to join Spark Crowdfunding: https://www.sparkcrowdfunding.com/register

RedZinc: https://www.sparkcrowdfunding.com/campaign/redzinc

RedZinc’s cloud-based proprietary technology enables healthcare professionals to conduct real-time video consultations on secure next generation networks. European grants of more than €2 million have helped RedZinc invest in product development and market research. The company has some excellent reference clients and is already generating annual revenues of more than €300,000. To view the campaign video and learn more about this investment opportunity, please click here.

Please note that only registered investors of Spark Crowdfunding may view the full details of the campaign, but it takes less than two minutes to join Spark Crowdfunding and it’s free, with no obligation to invest. Click here to join Spark Crowdfunding: https://www.sparkcrowdfunding.com/register

Donegal Entrepreneur is Raising F...

Donegal Entrepreneur is Raising Funds for Global Expansion

There’s no stopping Jenni Timony from Donegal Town!

Her fast-growing and highly profitable e-commerce business, FitPink, which is focused on the lucrative leisure-wear market for women, has had a phenomenal first two years in business.

Launched in July 2019, FitPink sold €470,000 worth of goods last year and generated a Net Profit of €70,000. This year, it is on target to sell a whopping €1.3m worth of goods and make a Net Profit of €240,000.

Now, for the first time, Jenni is raising funds to accelerate the already impressive growth rates of the business. She is raising €300,000 from small to medium sized investors on the Spark Crowdfunding website and has already raised over €167,000 in the first two weeks of the campaign.

To date, the company has received over 2,000 positive product reviews on its website and has built a database of over 10,000 online customers.

This is a unique and exclusive opportunity to invest at the very early stages of a business experiencing very high growth rates and with global expansion plans.

40% TAX REFUND FOR IRISH INVESTORS

An added incentive for Irish taxpayers is the very attractive 40% Tax Refund on amounts over €250 that are invested in FitPink, due to the fact that FitPink is an EIIS qualifying company. What this means is that an investment of (say) €1,000 only costs the investor a net amount of €600 as the investor can reclaim €400 in the form of a tax refund.

FORMER ENTREPRENEUR OF THE YEAR FINALIST

The company founder, Jenni Timony, is a highly experienced entrepreneur and has previously managed the Enterprise Ireland New Frontiers Programme in the North-West of Ireland. She is also a former Finalist in the prestigious EY Irish Entrepreneur of the Year annual awards.

HOW TO FIND OUT MORE ABOUT INVESTING IN FITPINK

You can watch a short video about FitPink by clicking here: https://www.sparkcrowdfunding.com/campaign/fitpink

HOW TO INVEST IN FITPINK

58 other investors have already invested in FitPink, in amounts from €100 upwards. If you would like to invest in FitPink you need to first register as an investor on the Spark Crowdfunding website. This is free and takes less than 2 minutes. You can register by clicking the green button here: https://www.sparkcrowdfunding.com/

Once you have registered as a member, you simply click on the FitPink campaign and enter the amount you would like to invest. Investors pay no fees or commission to Spark Crowdfunding. The minimum investment amount is just €100. Amounts less than €5,000 can be paid by Debit Card. For amounts above €5,000 you will be sent a link to make the direct bank transfer through Stripe.

Please email us with any questions to: info@sparkcrowdfunding.com

EIIS tax relief – what you need...

EIIS tax relief – what you need to know as an investor

EIIS is an Irish tax relief available to individuals for investments in qualifying SME startup and growth companies.

The relief is only available where the company meets various conditions. On crowdfund platforms the companies will usually qualify but this status should be checked on their campaign page. Not all companies qualify and (for example) relief is not available for investments in construction or professional services companies.

How it works

An individual can claim a refund of up to 40% income tax back on an investment – so an investment of €10,000 can result in a tax refund of €4,000.

The EIIS is offsetable against an individual’s total income which can reduce (for example) rental income, salary and dividends. It can also reduce non routine income such as Share Options gains, termination payments and ARF distributions. It is one of the very few total income tax reliefs available.

The level of the refund depends on tax paid in a year and 40% is the maximum available, being the top rate of income tax. Personal circumstances vary and an investor should ensure they have enough taxable income in the year of investments.

The relief is only available against income tax and can not reduce USC or PRSI liabilities.

Example

Generally a single individual starts paying top rate 40% income tax at €35,300 annual income. This person would need to have annual income of at least €40,300 to receive 40% tax back on a €5,000 investment. In contrast, an individual on (say) €35,000 salary making the same €5,000 investment would receive a refund of 20% tax back.

Key conditions for an Investor

For investments made after 1 January 2021, then these are the key investor conditions:

- Investors will be taking on risk of investment failure. They should determine the suitability of EIIS based on their own personal circumstances. EIIS qualifying companies are, by their nature, high risk investments.

- An investor needs to keep the shares for at least 4 years - if they sell before the end then the relief is withdrawn. For investments above €250,000 then a 7 year holding period applies and relief is capped at €500,000 annual.

- The minimum investment is €250 but some companies can have a higher threshold for EIIS investors (generally €1,000).

- Each investor is responsible for submitting their own tax refund claim to the Irish Revenue. Details are below.

- The investor must not be connected (in accordance with a wide tax law definition) to the company. This condition can be complex and needs to be reviewed further if likely to be applicable.

- The investor needs to be resident in Ireland. In certain circumstances, a non Irish resident may qualify if they have Irish taxable income.

Making a claim for the relief

The tax refund is not automatic and needs to be claimed by the individual.

After subscribing for shares, an investor has to wait until the company sends them a formal “Statement of Qualification” (SOQ). This is a crucial document.

This can generally take a few months as the company needs to have spent 30% of the monies received. It is only at that point that they can submit formalities to Irish Revenue, which will ultimately enable them to issue the SOQ to each investor.

It is only when an individual receives the SOQ that they can make a claim to Revenue for the refund.

Accelerating the refund